Why Most Traders Quit

I have said this many times.

You only lose when you quit.

Until then you’re either earning or you’re learning.

But the issue is majority of people quit trading.

And it goes far beyond just money lost. I say that because the essence of trading is playing with money you can afford to lose and you can psychologically handle.

Right?

So, it goes beyond money. If you’re thinking of quitting trading, first give this piece a read and let’s identify the cause and it might help you to carry on.

You’re closer today to achieving your trading goals than yesterday.

The Pitfalls of Financial Trading

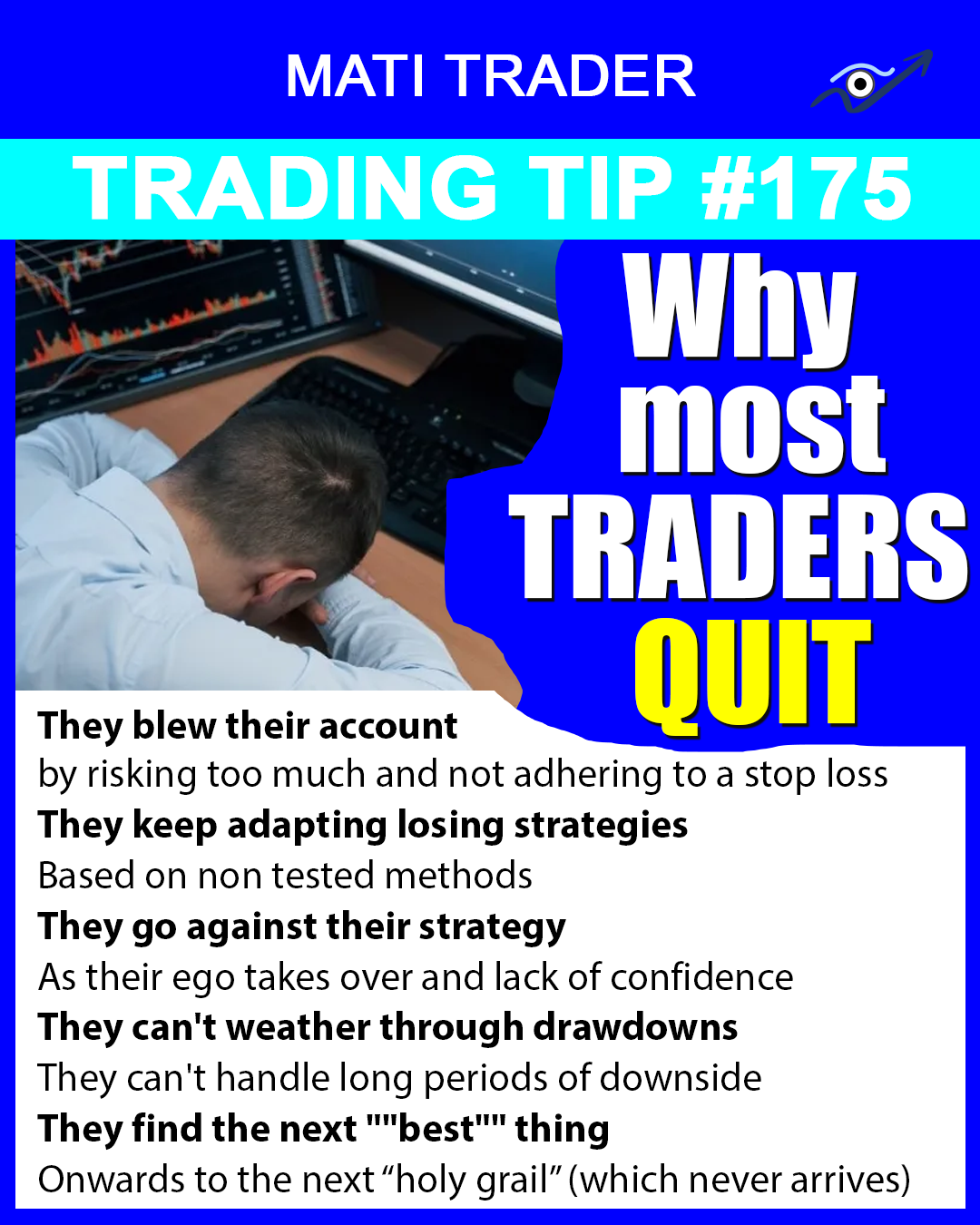

REASON #1: They blew their account by risking too much

One of the primary reasons why many traders ultimately quit the financial markets is the common mistake of blowing their trading account.

There are three main reasons you blew your account.

You risked far too much on certain trades.

You did NOT adhere to strict money management principles.

Your portfolio was tiny (Under $1,000) to start off with. So the costs, the brokerages, the margins were all too much.

It’s like flying a plane at a low altitude hoping you won’t strike a mountain.

REASON #2: They keep adapting losing strategies based on non-tested methods

Another reason for you to abandon your trading is this.

Your methods, strategies and systems are losers.

If you back and forward test, it yields negative results.

So, technically the system is achieving what its numbers are in a way.

I’ve back tested a LOT of strategies in my youth.

100s of thousands of parameters, indicators and criteria.

And 89% of them were just plain losers.

Don’t think by logic, that the system will work.

Don’t think by a few months, will dictate a systems complete and eternal performance.

Don’t just follow a trader’s strategy and adapt to your own without any backtested results.

Without proper testing and evaluation, you are at risk of adopting strategies that are based on faulty assumptions or rely on limited historical data.

REASON #3: They go against their strategy as their ego takes over and they lack confidence

Ego is a dangerous trait to have as a trader.

And with you feeling like you know better than the market and deviating from your plan, is a recipe for disaster.

Do it once, you’ll do it again.

Do it a few times, and you’ll get right back on that emotional roller coaster that comes with trading.

And it will grow and infect your trading as it will lead to even more impulsive actions and irrational decision-making.

Your confidence will get shot.

Your vibrations within yourself will be depro and will reflect onto your trading performance.

The psychological pressures associated with trading can magnify the impact of losses and amplify self-doubt, ultimately push you out of the game.

REASON #4: They can’t weather through drawdowns

NOTE: Drawdowns, which refer to the decline in a trader’s account value from its peak, are an inherent part of trading.

Here’s something funny.

When you go through good times with trading, it almost feels normal.

And you can go through 6 months of great upside for your portfolio.

But when that one or two months drawdown kicks in (inevitably it will), time feels different.

It feels like an eternity of failure and with the feeling of you’re never getting out of this..

Unfortunately, many traders find it challenging to cope with these challenging phases, leading to frustration and ultimately quitting.

Am I right?

Well as my friend and great colleague Igor said to me: Your biggest winning streak and your biggest drawdown is still to come.

So you might as well embrace it with strict money management principles along the way.

Successful trading comes with the ability to easily withstand drawdowns and navigate through extended periods of market downturns.

Also, psychologically you may find as a new trader that when you endure through longer periods of downside in the market, it can be both mentally and emotionally draining.

Extended periods of drawdowns can cause a few problems:

-

It can erode a trader’s confidence

-

It can take away their optimism

-

It can make them feel envious over other traders who are winning

-

It can demotivate them to carry on

-

It can cause them to make irrational decisions

-

It can lead to over trading and revenge trading

-

It can make them quit. They find the next “best” thing, onwards to the next holy grail (which never arrives).

REASON #5: To continue the pursuit of the next “best” thing

People follow where they think the quick money it.

They are constantly on the quest to find their holy grail.

Sure, trading isn’t for everyone. And Yes trading is the hardest and most easiest way to make an income.

But, you seek will also require a ton of research, psychology, sacrifice and time.

Nothing of high reward comes without a degree of risk.

Bigger the reward, greater the risk.

Or everyone would make a ton of money, right?

So don’t fall into that trap of jumping to the next lily like a frog…

Traders who constantly search for the next big thing end up chasing elusive dreams instead of focusing on developing their skills and understanding the markets.

The reality is that there is no magic strategy that guarantees success in trading.

The markets are ever-changing, and what works today may not work tomorrow.

It is important for traders to recognize that trading success is not about finding a secret shortcut or relying on external factors beyond their control.

It is about continuous learning, discipline, and a willingness to adapt to changing market conditions.

Develop your robust trading plan, manage your risk effectively, and stay focused on long-term goals.

Those factors alone will keep you on the right quest to trading well.

Trade well, live free.

Timon Rossolimos

Founder, MATI Trader

CONNECT WITH US:

Facebook Group:

http://www.facebook.com/groups/matitrader

Website:

http://timonandmati.com

Discord:

https://discord.gg/c8f37kyv35

Order via our secured website:

Click here to order The Complete Charts Patterns and Candlesticks Guide by MATI Trader book

Or order via EFT payment”

Click here to order the book via EFT (all info in the invoice).

Enjoy and remember…

You won’t need to buy or order another book on chart patterns and candlesticks ever again as I will be updating it very often and will let you know.

Not sure the best way to get started with MATI Trader?

Follow these steps to start your successful trading journey.