Compounding Trading Explained

Listen up.

If you want to grow your portfolio exponentially, you’ll need to understand this concept.

It’s called ‘compounding’.

In short,

Compounding is a strategy where you allocate your money with your

original and current portfolio in order to reinvest it

and grow it into an even larger portfolio.

Let’s cut to the chase with an example.

Meet Jack and Jill.

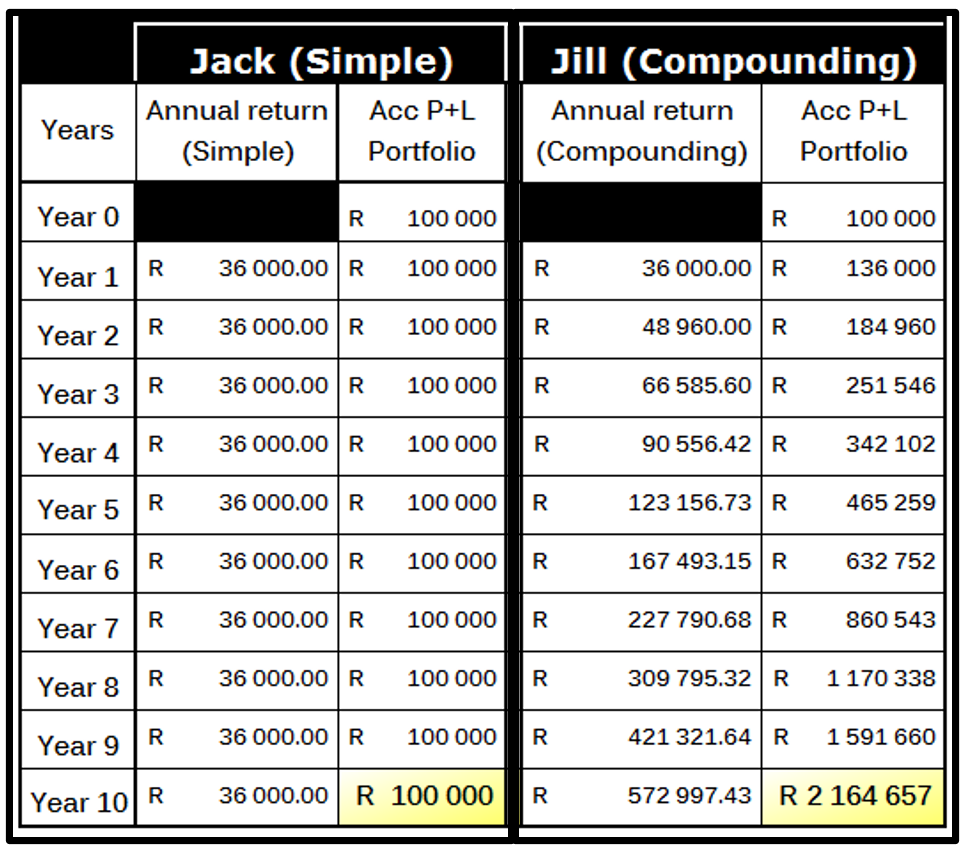

Jack and Jill both deposit R100,000 into their trading accounts and they decide to follow each other’s trades exactly. At the end of the first year, their portfolio performances were identical.

As they enter their second trading year, Jack decides to do one thing different to Jill.

He decides to withdraw all his profits so that he can enjoy a lavish holiday.

Jill on the other hand, decides to reinvest her profits. This way, in the next year, she’ll be able to grow her account even more.

They trade this way for the next 10 years. Let’s compare how their portfolios differ.

Simple trading versus Compounding trading in action

It is clear that Jill is a lot wealthier than Jack where, she has been able to grow her account from R100,000 up to R2,164,657 in just 10 years.

Jack on the other hand is right back to where he started, but with 10 memorable holidays.

Which position would you like to be in?

Every year, Jack takes on the simple interest trading approach.

This is where he continues to earn returns on his original portfolio value only.

At the end of each year, he takes out the R36,000 in profits, that he earned, and uses the money to go on a holiday.

Even after 10 years, Jack continues to bank a fixed R36,000 each year leaving his trading portfolio back to his starting account of just R100,000.

Jill on the other hand, takes the compounding interest trading approach.

This is where she continues to re-invest her earnings into her portfolio each year, in order to grow it even larger than the previous year.

After 10 years of trading, Jill’s R2 million trading account continues to snowball and compound each year.

The science of compounding is an extremely effective wealth building strategy.

This is one concept that I’ll go into a lot more detail in the Video 5 of the MATI Trader System Programme.

Trade well and look after yourself,

Timon Rossolimos

Founder, MATI Trader

PS: Did you enjoy the “Compounding Trading” article for the week? I’d love to hear from you by emailing timon@timonandmati.com

PPS: Did you watch the MATI Trader Video for the week? Click below to catch up.