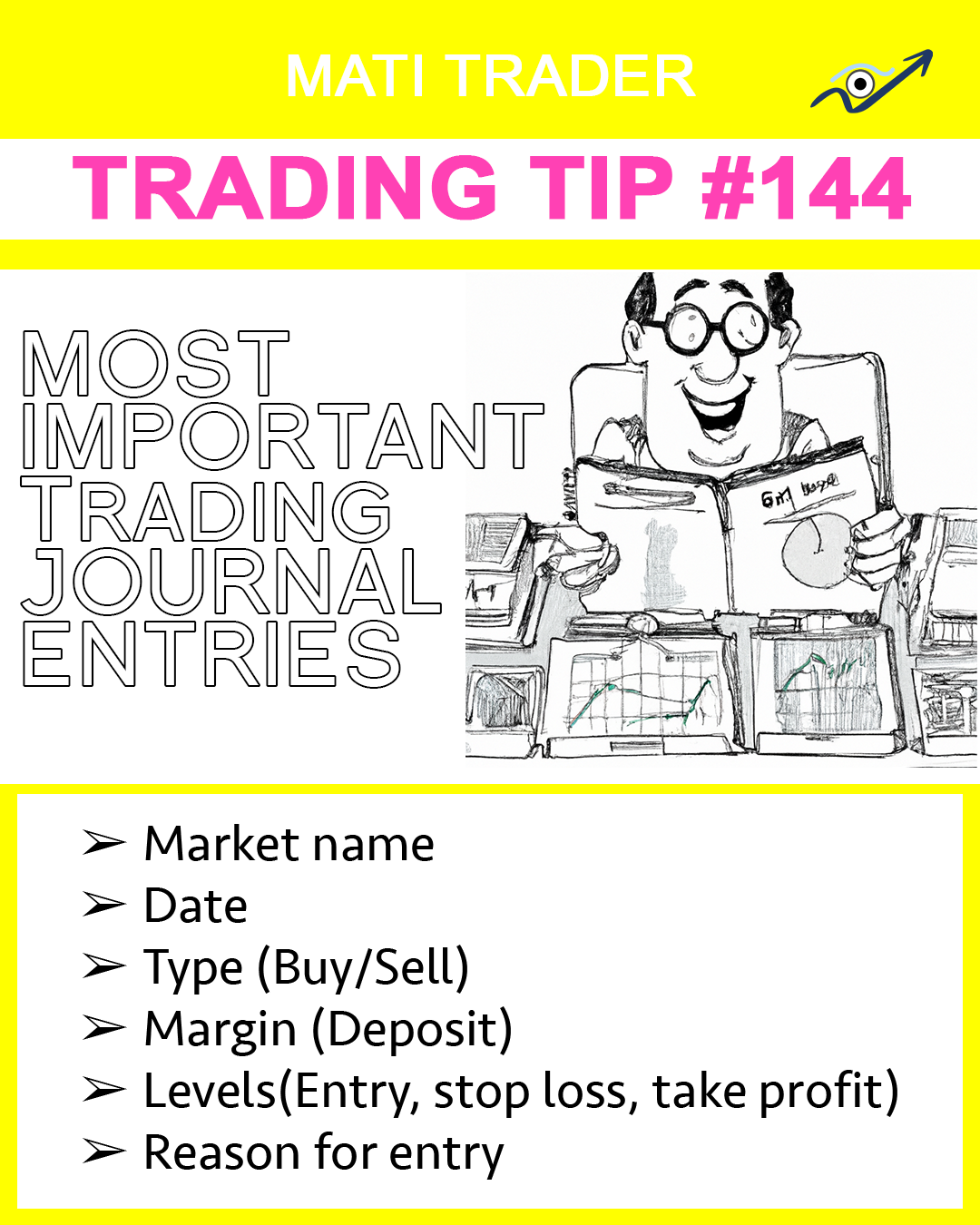

8 Most Important Trading Levels of Entry

I’ve given you over 30 different elements you can add to your trading journal.

But if you want to start off light and easier, then there are only a few KEY levels you’ll need to get into your trade and track them.

8 to be exact.

These include:

#1: Market (Stocks, Indices, Forex, Commodities, Crypto)

What market are you trading?

There are many different markets to choose from, including stocks, indices, forex, commodities, and crypto.

Each of these markets has its own unique characteristics, including volatility, liquidity, and risk factors.

When you specify what market you’re trading you’ll know which account to measure your portfolio.

#2: Date of Entry

This information will allow you to track your trades over time and evaluate the success of their strategies.

Also, something not many people think about is when you’re profitable and in the money. It is also useful for tax purposes, as you might need to report your gains and losses to the relevant authorities.

#3: Entry Price

The entry price is the price at which a trader enters a trade.

This information is critical for calculating potential profits and losses, as well as for setting stop loss and take profit levels.

You’ll also know how the market is moving relative to their position and make certain adjustments to your trades (following your strategy) as needed.

#4: Type Buy (Go long) or Sell (Go Short)

The type of trade, whether it is a buy or a sell short, is important because it determines the direction of the trade. If a trader buys a security, they are betting that the price will go up, while a sell short trade is a bet that the price will go down. This information is important for setting stop loss and take profit levels, as well as for understanding the risk profile of the trade.

#5: Stop Loss (Risk level)

A stop loss is an order to close a trade if the price reaches a certain level.

This is a key risk management tool that helps traders limit their losses in case the market moves against them.

Also, it’s used to lock in profits when the trade is going in your favour.

#6: Take Profit (Reward level)

Take profit is the opposite of a stop loss.

It is an order to close a trade when the price reaches a certain level of profit.

This allows traders to lock in their gains and exit the trade at a predetermined level.

#7: Margin (Initial deposit)

Margin is the amount of money a trader needs to deposit in order to open a position.

This is important because it determines the amount of leverage the trader is using and the potential risk exposure.

By recording the margin requirements for each trade, you’ll be able to monitor your overall risk exposure and adjust your positions if needed.

#8: Reason of Entry

The reason for entering a trade is important because it helps traders evaluate the success of their strategy and make adjustments as needed.

This depends on your trading strategy. Are you trading because of a breakout pattern, Moving Averages, Range bounded, Order blocks, Liquidity Sweeps, Volume Spread analyses or indicator analysis – you’ll be able to jot your entry reason for each trade.

So if you’re new to trading or not worried about the extras when plotting in your journal.

You now have the most important elements of a trading:

Markets, the date of entry, entry price, type of trade, stop loss, take profit, margin, reason.

Hope that helps.

Trade well, live free.

Timon Rossolimos

Founder, MATI Trader

CONNECT WITH US:

Facebook Group:

http://www.facebook.com/groups/matitrader

Website:

http://timonandmati.com

Discord:

https://discord.gg/c8f37kyv35

Order via our secured website:

Click here to order The Complete Charts Patterns and Candlesticks Guide by MATI Trader book

Or order via EFT payment”

Click here to order the book via EFT (all info in the invoice).

Enjoy and remember…

You won’t need to buy or order another book on chart patterns and candlesticks ever again as I will be updating it very often and will let you know.

Not sure the best way to get started with MATI Trader?

Follow these steps to start your successful trading journey.