5 Entry Orders You Need To Know

Back in the old days, to action a trade you only had two easy options.

Buy or sell…

Fast-forward into the present day, and today you get slapped with five different options to choose from when you get into a trade.

Right now, I’m going to simplify these five trading entry orders in way that you’ll never forget.

Entry Order #1: Market Order

The first entry order is the easiest to understand.

This is where you’ll buy or sell at the most current market price.

When you choose a market order, it is the quickest, most effective and easiest way to enter into your ‘long’ or ‘short’ trade at the current bid (buy) or offer (sell).

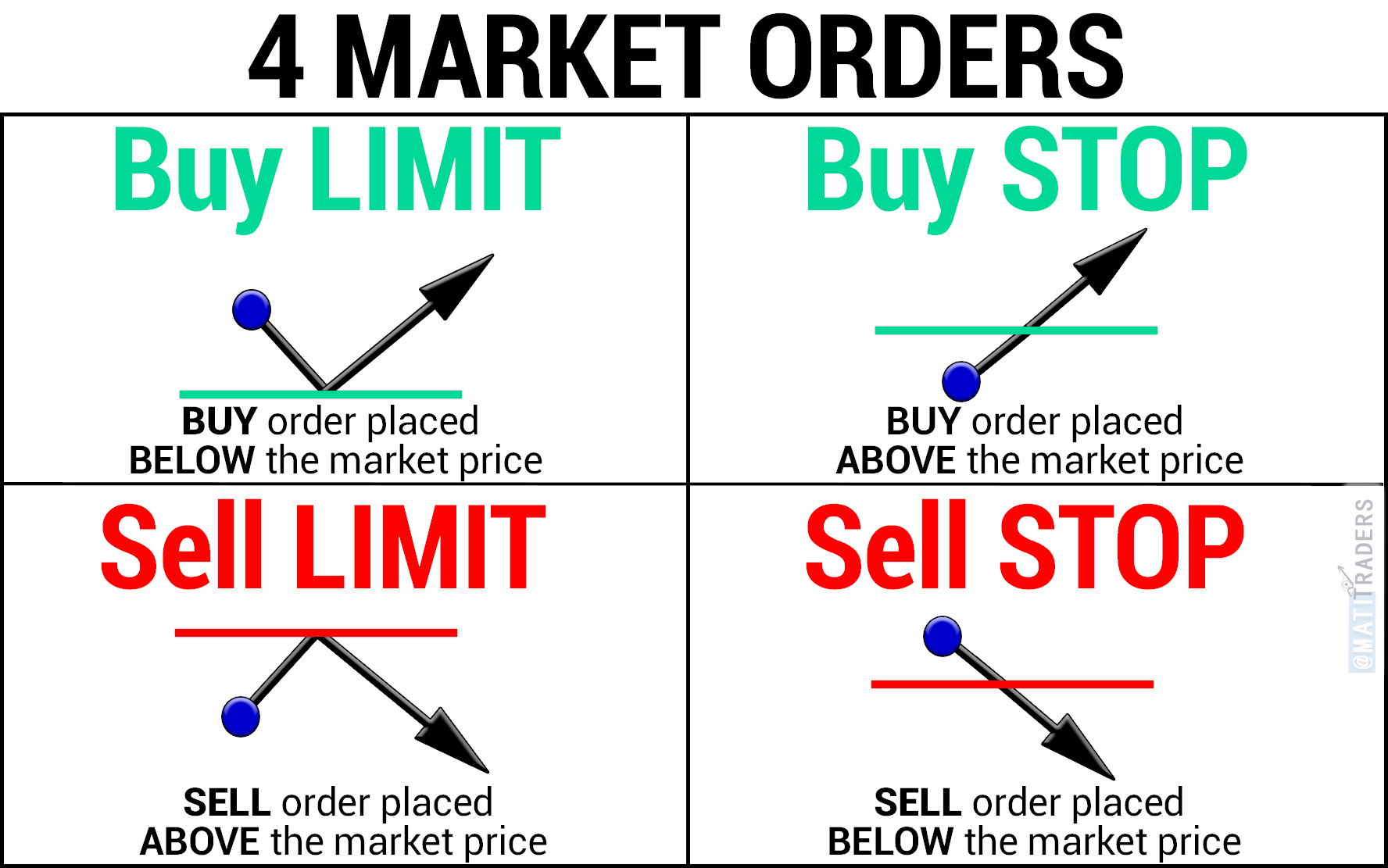

Entry Order #2: BUY Limit

When you place a ‘Buy Limit Order’, you’ll place your long trade entry price BELOW where the current price is trading at.

Once the market price drops on or below the Buy Limit Order price, you will be automatically entered into your ‘long’ trade.

EXAMPLE: BUY Limit

If BHP Billiton’s share price is currently trading at R305 per share and you would like to buy (go long) at R300 per share, you’ll choose the Buy Limit Order.

You’ll then wait for the market price to drop to your chosen order price or below it where you’ll then be automatically entered into your ‘long’ trade.

Entry Order #3: SELL Limit

When you place a ‘Sell Limit Order’, you’ll place your short trade entry price ABOVE where the current price is trading at.

Once the market price hits this entry point or above it, you will be automatically entered into your ‘short’ trade.

EXAMPLE: SELL Limit

If BHP Billiton’s share price is currently trading at R300 per share and you would like to sell (go short) at R305 per share, you’ll choose the Sell Limit Order.

You’ll then wait for the market price to rise to or above your chosen order price, where you’ll then be automatically entered into your ‘short’ trade.

Entry Order #4: BUY Stop

When you place a ‘Buy Stop Order’, you’ll place your long trade entry price ABOVE where the current price is trading at.

Once the market price hits this entry point or above it, you will be automatically entered into your ‘long’ trade.

EXAMPLE: BUY Stop

If BHP Billiton’s share price is currently trading at R300 per share and you would like to buy (go long) at R305 per share, you’ll choose the Buy Stop Order.

You’ll then wait for the market price to rise to or above your chosen order price, where you’ll then be automatically entered into your ‘long’ trade.

Entry Order #5: SELL Stop

When you place a ‘Sell Stop Order’, you’ll place your short trade entry price BELOW where the current price is trading at.

Once the market price drops on or below the Sell Stop Order price, you will be automatically entered into your ‘short’ trade.

EXAMPLE: SELL Stop

If BHP Billiton’s share price is currently trading at R305 per share and you would like to sell (go short) at R300 per share, you’ll choose the Sell Stop Order.

You’ll then wait for the market price to drop to your chosen order price or below it where you’ll then be automatically entered into your ‘short’ trade.

To conclude the four main buy and sell limit orders, here’s a summary table I’ve created for you.

Print it, laminate it and stick it on your wall.

This way you’ll never forget how these market entry orders work.

Trade well,

Timon Rossolimos

Founder, MATI Trader

PS: Did this article help clarify the market orders available to trade?

Let us know via email at info@timonandmati.com or click here to let us know in our MATI Trader chat room.